Contents

Dedication v

Acknowledgments vii

Introduction xv

1 So You Want to Trade FOREX? 1

Two Wolves 1

Follow the Rules 4

Your Personal Litmus Test 5

Your Life’s Purpose 14

Conclusion 15

2 Introduction to the FOREX 17

History of the Forex Market: How It All Began 19

What Is the FOREX? 21

Types of Traders 22

How Do Traders Get Paid? 23

Bulls and Bears 25

Types of Orders 25

3 Self-Empowerment via Trading Software 31

How to Determine Market Direction 35

Using Indicators to Determine an Entry Point 37

Using Indicators to Determine Exit Strategies 41

Using Multiple Time Frames to Trade 44

Conclusion 44

4 Trading Japanese Candlesticks 47

The History of Japanese Candlesticks 47

How to Read a Japanese Candlestick 49

Reading a Japanese Candlestick Chart 50

How to Find a High 50

Understanding the Different Japanese Candlesticks 52

Candlestick Formations 56

Bullish Candlestick Formations or Buy Signals 57

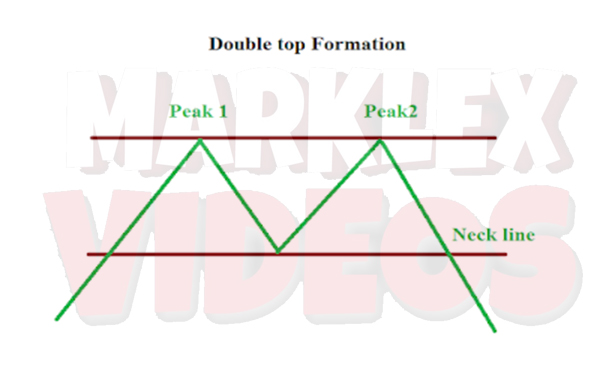

Bearish Candlestick Formation or Sell Signals 62

Trading Candlestick Patterns 68

Conclusion 70

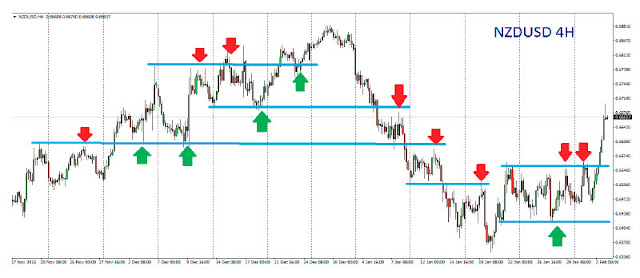

5 The Financial Game of Support and Resistance 71

The Game 73

How do Bulls and Bears Score Points? 74

Identifying Highs and Lows 75

Resistance and Support 75

Learning to Short the Market 81

Past Resistance can Become Future Support 83

6 Trends and Trendlines 89

A Trend Is Your Friend 89

Trading a Trend Until it Bends 91

Spotting an Uptrend 96

Drawing Uptrend Lines 97

Finding and Drawing Inner, Outer, and Long-term Uptrend Lines 98

Incorrect Ways of Drawing Uptrend Lines 100

Finding and Drawing Downtrend Lines 105

Finding and Drawing Inner, Outer, and Long-term Downtrend Lines 106

Incorrect Ways of Drawing Downtrend Lines 107

Trends Inside of Trends 109

Trading Channels 110

The Value of Trend Lines 111

Conclusion 111

7 Buy and Sell Zones 113

Trends 115

Buy and Sell Zones 117

The Sell Zone 117

Shorting the Market When It Enters the Sell Zone 121

The Buy Zone 122

Going Long in the Market When It Enters the Buy Zone 126

Conclusion 126

8 The Fibonacci Secret 129

The History of Fibonacci 131

The Fibonacci Numerical Sequence 132

The Fibonacci Sequence in Nature 132

The Fibonacci Retracement and Extension Ratio Relationship 140

The Value of Adding the Fibonacci Numbers to your toolbox 146

Conclusion 147

9 The Reality of the Fibonacci Secret 151

Fibonacci Market Movement on September 11, 2001 151

Fibonacci Retracements Everywhere 155

Conclusion 158

10 Fundamental Analysis 161

Fundamental Announcements Analysis 161

Trading Days Versus Trending Days 167

Increased Risk with Trading Fundamental Announcements 168

World Economies 170

The Importance of Fundamental Announcements 171

Conclusion 174

11 Consolidating, Bracketing,Accumulation, or Sideways Movement 175

Consolidation Factors 176

Strategy 1 178

Strategy 2 181

Not All Fundamental Announcements Move the Market 182

Strategy 3 183

Bull and Bear Traps 184

Conclusion 185

12 Learning the Rules of Equity Management 187

What Is Equity Management? 187

The Equity Management Formula 193

Risk versus Reward 195

Percentages Mean Nothing When Trading 195

Conclusion 197

13 The Final Analysis 201

Education First 204

Our Habits Control Our Lives 205

Finding Your Pot of Gold 205

Glossary 209

Index 213