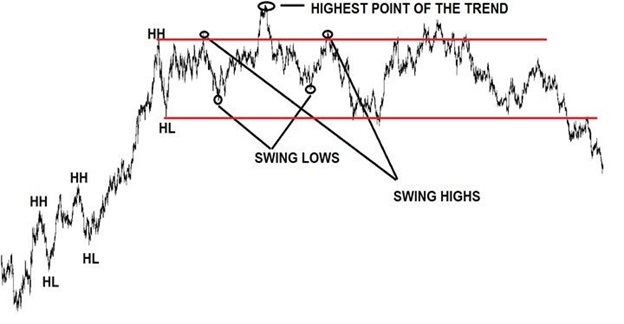

Let’s see another example of a trend turned into sideways movement but this time with an uptrend.

This is an uptrend as price is making new highs and new lows. After the third HH price tries to go further up and make a new HH but it fails and comes back down to make a swing high and a swing low contained by the last HL-HH pair. This is a strong indication that a range is about to develop. You will see later on what is the second thing on this chart that screams there will be a trading range. After that, price does manage to go further up past the last HH only to come back down shortly and make another pair of swing high-swing low inside the territory of the last pair of HH-HL. This was a very lengthy period of sideways movement and it would have been very profitable if spotted from its very beginning. Okay, it should be very clear by now how to use price action to see if a pair in

trending or ranging.

Strong Impulsive Move Now that you know how a trending market and a ranging one look like it is time to start from the beginning and see how you can judge if a trading range is likely to develop just by looking at price action. If you look at all the ranging market examples above you will find that they have something in common. The last impulsive move of the trend or the strong move in line with the trend, before sideways movement starts to develop is very big and almost vertical, with no relevant corrections.

Whenever there is a trend is place and you are trading with it based on your trend following system, if you see such a big impulsive move it is time to stop what you are doing to and prepare yourself for a trading range.

This is the first clue price action is giving you that the trend is about to end and the pair is preparing for sideways trading.

Of course, this is not 100% accurate but in the majority of situations, when you see a strong directional move with no corrections like this one, it is very likely that the pair will start to trade sideways. This is the time to disregard your”trade with the trend” trade setups and prepare for range trading. As a general rule, this strong and steep move should be at least two times bigger than the last correction move of the trend. You can use the Fibonacci retracements tool to judge this.

The last correction move that precedes the big impulsive move up is the small red line pointing against the uptrend. You can see by plotting the

Fibonacci retracement levels from the start to the end of the impulsive move, that it is more than twice the size of the correction move. If the 50% retracement level was situated right where the correction begun at the second HH of the trend, then the impulsive move would have been

The logic behind this is the following. In these two examples the trend is up so the buyers are stronger than the sellers, they are in total control and they start from the bottom to push the price up. The corrections mean that these buyers are closing some of their orders and taking

profits out of the market. When the correction unfolds and the price comes back down at an advantageous price they buy again and push the price higher. When they push the price up that fast and with no corrections it means that nearly all the people who wanted to buy that pair have done so and pretty soon there will be no one left to buy. At the same time, the huge amount of traders who went long will have to start to close their orders and take profits out of the market.

That is the time when the impulsive move finally ends and the sideways movement begins. The buyers have pushed the price too high and too fast and they are exhausted, they will be taking profits for some time, they will not be pushing the price further up anytime soon. On top of this, if you look at the way trends behave you will see that if there is a small impulsive move, the following correction will match that move. If the impulsive move is huge like in the above chart, you should always expect the correction move or trading range to be sizeable in length and in time. The bottom line is, when a strong and steep impulsive move without noticeable corrections takes place, you should always prepare yourself for range trading. This is not a mandatory condition for a trading range to take place, there will be from time to time trading ranges without huge impulsive moves preceding them, but I have found that in about 90% of situations they form after moves like this.

Swing High-Swing Low Rule

If the big impulsive move preceding the range helps a lot but it is not a necessary condition this one is the number one rule when it comes to identifying a range and it is mandatory. This refers to what we talked about earlier when discussing the technical differences between trending and ranging markets. After the strong impulsive move, you have to see price making a swing high and a swing low that are confined in the recent price action territory. Let me illustrate this.

The trend is down. After making that last LL, price stays above it for a while and makes a first swing high and a first swing low without going higher than the last LH or lower than the last LL. This is a very clear indication that the trend has stopped or paused and a trading range is very likely to develop. As long as the price stays confided in that red rectangle this pair is moving sideways and you should look to trade a range if one forms. Let’s see another example.

The same thing happens here. The trend changes from downtrend to an uptrend after which price makes a swing low first and a swing high after it, both of them inside the recent price action territory. This is how trading ranges start and this rule of the swing high and swing low must always be respected. Please note that the swing high and the swing low must be relevant for price action on the timeframe you are in. Make sure that they are of roughly the same size or degree as highs and lows of the surrounding price action. This is the same situation like the one you have when labeling the trend’s highs and lows. Let me illustrate this.

0 Comments:

Post a Comment