Again, I like to look at previous blogs and re-examine our thoughts on where the market was going to go. Below is a blog made as the rescue of sovereign debt recovered life and there were other packages of future stimulation. As the EU sovereign debt bailout returns to life and other economic stimulus packages are on the horizon, it might be time for traders to find the market fund with Japanese candles. Two things drive stocks and stock market prices. They are the fundamentals of economics and individual actions on the one hand and market confidence on the other. Both in trading and in a long-term investment, the margin of safety and the intrinsic value of the stock are good measures of the value of an action. What may seem like a promising action with a low price / benefit ratio that can be cheap when looking at earnings but the confidence of the market can make the stock remain inactive and cheap. Market confidence is a common drive from each day to day of the trader to one that is only undertaken to buy and continues to invest. While fundamental analyzes help detect a stock's value hidden in a market, it is often more profitable to find the market fund with the Japanese candles. A technical analysis of action with tools like a chart of Japanese candles is useful in the detection of new market trends and market investment.

If a trader or investor is looking for profitability with a market change, it will do well to find the background with the Japanese candlestick patterns and operate or invest accordingly. It is okay to talk about finding bargains in a low market but for how long the market will be low and for how long will a given stock be ignored by the market? Both fundamental and technical analysis are necessary in short-term trading and long-term investment. However, it is with a Japanese candle analysis that smart traders are often able to spot when the market is going to change and start to be profitable by buying in the background. To find the market background with Japanese candle analysis for both the general market and individual stock prices, traders follow stock price patterns and their representations as it is easy to read the Japanese candle signs.

Patterns of Japanese candles

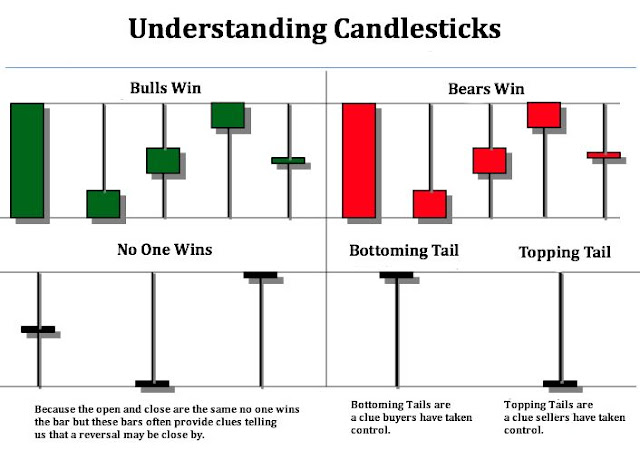

Japanese_vels patterns A useful common sign is the Japanese Doji candles. This Japanese candle signal indicates market indecision. The Doji is a very short and practically level candle with long and lower tails. He tells you that the market has opened and closed in a stock at almost the same price but that the market has tested both the high and low during the trading period. This signal often precedes a leak. It is not especially useful in a flat market as it does not tell you which direction the stock market or the individual stock will go in but in a bullish or bearish market trend, it will often warn the trader of a change. In a falling market, it is a way to find the bottom of the market with Japanese candles.

After just selling $ 2.5 trillion worth of markets, many people are predicting that the market has touched the bottom. The intelligent stock investor or stock trader can not depend on the experts. He will work to find the market fund with the Japanese candles and rent later with the trading tactics of the Japanese candles.

0 Comments:

Post a Comment