For the most part, day and swing traders use all forms of market analysis to identify opportunities from specific chart patterns that demonstrate frequent reoccurring results.

They need to trade in active time periods, using trend lines and moving averages, both of which are a form of trend line analysis; these will help in certain market conditions. We will go over a different set of moving averages than what is normally written about; this will help identify conditional changes in the market, thereby giving forex traders a better edge. We will also incorporate and show you how to calculate support and resistance levels from such mathematically based models as pivot point analysis and other means, such as Fibonacci corrections and extensions, to identify opportunities and drive trading decisions.

These are the methods I will be covering in this book to help you form a trading plan based on specific rules and conditions for trading the forex market.

This trading book should help you learn the methodology of the best and most effective trading techniques to harness and capture consistent results in the forex market. Consider this like market analysis on steroids. This book combined with the compact disc (CD) should help you learn in the most effective fashion. By rereading and continually studying this material, these study tools will help you change the way you trade and leave you with a specific set of rules on when to enter a position; how to identify a trade setup, a trigger, or entry execution order; and how to effectively place a stop and know when to exit a trade without hesitation. Most successful traders live by the adage, Buy low and sell high; really great traders also know when to buy high and sell even higher.

The best traders in the world also take advantage of short selling, which is one aspect that draws so many skilled traders to the forex market; they can sell short at extreme price highs and buy back at lower prices.

Whatever your method is, the results need to be profitable or your career as a trader will be cut short. Whether you are a position trader, a swing trader, or the more popular day trader, the key to profits is to try to capture a portion of a price move in order to generate a positive cash flow (make money). A trader’s search for discovering a method that generates consistency in positive results is the primary goal and should be a continuous learning event. There is one common feature among successful traders, and that is that many of them are prepared before trading and have a formulated game plan.

The techniques in this book can be applied to other markets, but this specifically targets the forex market. I will teach you a trading system so that you develop your own personal program and then follow that plan.

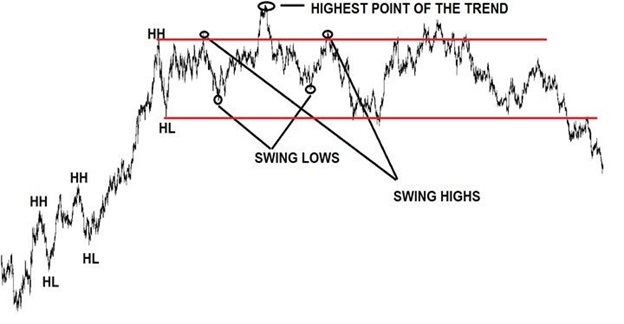

Using these techniques should help you to effectively anticipate a potential resistance or support level that will give you an edge in the market for both entering and exiting positions. Blending the strengths and characteristics of candlestick chart pattern recognition with pivot point analysis is what I have been teaching private investors, professional traders, and other leading educators. Many new methods have been introduced to traders, but the one constant is human emotional behavior. In order to master trading, people need to control their emotions. After all, the markets are simply a reflection of these emotions. Fear of losing money causes market prices to head lower as people sell; and fear of missing an opportunity causes market prices to move up as greedy people buy, trying to catch a free ride. As a forex trader, you are looking at technical analysis to help capture profits from a movement in price. Therefore, it is imperative that you understand how and when a market moves and what signals or patterns give you a clue for a directional price move. There are consistently recurring patterns and these are what I plan to share with you in this book. I will also discuss methodologies on trade management and risk management to help you when an inevitable trading loss occurs.