What are moving stockings?

Moving stockings are the most used indicators in the technical analysis and indicate the average price at a certain point in time with respect to a defined period of time. The term mobile is used as they reflect the last average of prices while at the same time they are held together at the same length of time throughout the series.

It should be noted that the moving average is, however, a delayed indicator that does not manifest the price variations immediately, therefore we can not necessarily use it as an indication of change in the market trend. With regard to this, it all depends also on the period of the moving average. For example, an average with a shorter period of time as it can be 5 to 10 minutes, would serve to better reflect the immediate behavior of the price than a moving average with a period of 1 day.

Also, this indicator can be used by combining two moving averages of different defined times. In this way, the trader can make all the combinations that he wants of moving averages choosing those that to his taste indicate to them in a clear way signals of entry/exit of the market. These signals typically come from the crossing of one half to the other. For example, suppose you use an average of 6 periods and another of 14 periods. The purchase signal is generated when the lower-term average crosses over the higher average term. On the contrary, the sales signals occur when the shortest period moving average crosses the moving average of longer period. Many trading techniques use this simple principle but combined with other indicators to confirm the signals.

Practically all the operations platforms today incorporate the mobile stockings between their basic indicators so there is no need to calculate them. However, for didactic purposes we will indicate how it is done. Basically, two types of moving averages (MA) are used in the technical analysis described below:

Simple moving Average

The simple Moving average (SMA) or arithmetic is calculated by adding a certain amount of prices of a specific number of periods of time, dividing this result between the number of periods of time. The result is the average price in that period of time. Simple moving averages use the same weighting for all prices (all prices have the same value) and are calculated by the following formula:

SMA = SUM (closing prices)/n, where n is the number of periods.

The average SMA is the average of the prices for a certain period of time. Normally, the closing prices of each period are used for calculation, although the setting of this indicator allows you to choose others, such as the maximum price, the opening price, the minimum price, etc.

On their own, the SMA constitute a simple and easy way to soften the price movements while offering a smoother correlation between the price of a certain financial instrument and the course of time. The SMA period is the time interval on which the average price is calculated. For example, a period of 10 will cause the SMA to be calculated based on the last 10 periods of time (candles or bars of 10 minutes, hours, etc in the graph). Thus, if we are using a 4-hour graph, the 10-period SMA is calculated based on the ten previous 4-hour candles/bars (it would be the average of the last 40 hours). With this it is deduced that it is the period the factor that affects the degree of softening of any moving average, because in greater period, the more the correlation between the price of the asset and the mobile average itself. It must be taken into account, however, that the greater the slower softening will be the reaction of SMA to the different changes in the instrument prices.

In the following picture you can see how Luna Mobile average moves with the price forming a line of greater "softness that the same price (click image to enlarge):"

Exponential moving average

The exponential moving average (EMA), like the SMA serves to offer a smoother correlation between the behavior of the price and the passage of time. The difference between the two moving averages lies in the fact that the EMA calculation attaches greater importance to the latest data obtained over a given period, ie it is a weighted average in which not all data have The same value. To calculate the EMA the following formula is used:

EMA (t) = EMA (t - 1) + K * [Price (t) - EMA (t - 1)]

Where you have to:

T = current value.

T-1 = previous value.

K = 2 / (n + 1) (n = period selected for EMA)

As can be concluded from looking at this formula, the value of the previous EMA and the current price of the asset analyzed must be taken into account for the calculation of the current value of the EMA, which means that the last values are having more weight in the final result in comparison With the first values obtained during the chosen calculation period.

This means that EMAs react more quickly to recent and sudden changes in the behavior of the price of any instrument being analyzed, such as currency pairs, stocks, commodities and others. In this way, the most recent EMA values are mitigated the possible price spikes (sudden up / down movements) that normally occur in the market regardless of their trend.

To better understand this, suppose we have the following price values in the EUR / USD for periods of 5 minutes: 1.3005, 1.3010, 1.2990, 1.3007 and 1.3015. We can see at a glance that this set of prices form a series that has a growing trend. However, it can be observed that there was a downward spike in the value of the second period. An SMA gives the same weight to this peak as to other data which could produce a confusing final value that does not reflect the general behavior of the price. However the EMA would be able to provide a higher final value and therefore more updated, which would be to mitigate the effect of the peak to the low of the second data. This ultimately allows the EMA to react more quickly to recent rises and more accurately reflect the upward behavior of the data.

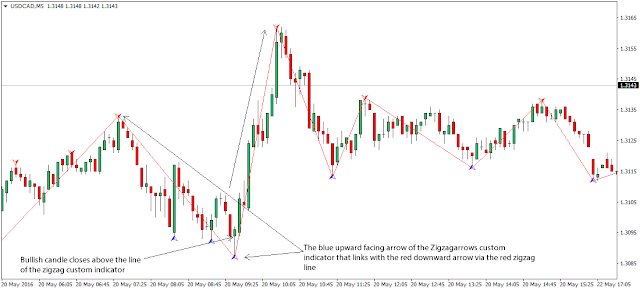

This graph is using a simple moving average of 10 periods and an exponential moving average of 10 periods in order to compare both. As can be seen, EMA of 10 reacts more rapidly to changes in the price movement because it is more sensitive than its counterpart, the SMA of 10 periods.

Exponential moving average vs simple moving average

From now on, the question that many traders ask is: Which is better, the EMA or the SMA?

The reality is that both moving averages have their advantages and disadvantages and can be used for various purposes. Because the advantages of one type of moving average constitute the disadvantages of another and vice versa, both moving averages can be used and combined to take advantage of their respective strengths and weaknesses. For example, EMAs typically generate more false signals because they move faster along with the price of the instrument, while SMAs, on the other hand, by reacting more slowly to changes in prices, serve precisely to avoid this. However, SMA's slowness in the face of changes in trends causes it to produce signals that are too late to enter the market, which may cause the trader either to lose good chances or enter when the movement is nearly complete Which could lead him to be trapped in a movement that turns against him. In this case, EMAs would be more useful in order to enter the market as quickly as possible once a new trend is detected.

So the decision to use one type of moving average or another depends on the trader and his strategy to operate in the market. If this trader wants to have fast market information, it is best to use a short period EMA, on the other hand if you want to have durable information about a dominant market trend, it is best to use a period SMA The most usual is that analysts use a set of moving averages over various periods of time. For example, in many cases the trader uses a long-term moving average to provide information on the general trend that dominates the market and a short period moving average that provides information on the current price behavior and allows him to determine a good point Market entry in the direction of the main trend. This point in many trading strategies is a cross of two or more means depending on the strategy used. The techniques of trading based on crosses of means are the most used by both novice and experienced traders.

Below is a chart with a series of crosses of moving averages that can be used as signals to enter the market (enlarge the image by clicking):

Simple moving Average

The simple Moving average (SMA) or arithmetic is calculated by adding a certain amount of prices of a specific number of periods of time, dividing this result between the number of periods of time. The result is the average price in that period of time. Simple moving averages use the same weighting for all prices (all prices have the same value) and are calculated by the following formula:

The average SMA is the average of the prices for a certain period of time. Normally, the closing prices of each period are used for calculation, although the setting of this indicator allows you to choose others, such as the maximum price, the opening price, the minimum price, etc.

On their own, the SMA constitute a simple and easy way to soften the price movements while offering a smoother correlation between the price of a certain financial instrument and the course of time. The SMA period is the time interval on which the average price is calculated. For example, a period of 10 will cause the SMA to be calculated based on the last 10 periods of time (candles or bars of 10 minutes, hours, etc in the graph). Thus, if we are using a 4-hour graph, the 10-period SMA is calculated based on the ten previous 4-hour candles/bars (it would be the average of the last 40 hours). With this it is deduced that it is the period the factor that affects the degree of softening of any moving average, because in greater period, the more the correlation between the price of the asset and the mobile average itself. It must be taken into account, however, that the greater the slower softening will be the reaction of SMA to the different changes in the instrument prices.

In the following picture you can see how Luna Mobile average moves with the price forming a line of greater "softness that the same price (click image to enlarge):"

Exponential moving average

The exponential moving average (EMA), like the SMA serves to offer a smoother correlation between the behavior of the price and the passage of time. The difference between the two moving averages lies in the fact that the EMA calculation attaches greater importance to the latest data obtained over a given period, ie it is a weighted average in which not all data have The same value. To calculate the EMA the following formula is used:

EMA (t) = EMA (t - 1) + K * [Price (t) - EMA (t - 1)]

Where you have to:

T-1 = previous value.

K = 2 / (n + 1) (n = period selected for EMA)

As can be concluded from looking at this formula, the value of the previous EMA and the current price of the asset analyzed must be taken into account for the calculation of the current value of the EMA, which means that the last values are having more weight in the final result in comparison With the first values obtained during the chosen calculation period.

From now on, the question that many traders ask is: Which is better, the EMA or the SMA?