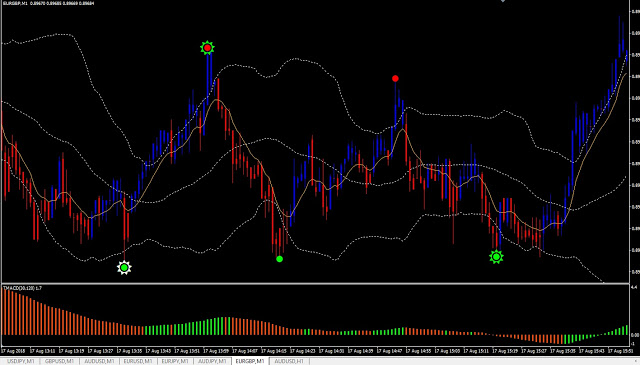

One of the main reasons why we use MACD is to show the divergence MARKET. Divergence occurs when the main sails graph showing a rising trend, for example, a purchase, but MACD shows a downward trend, for example, sell and vice versa. Here are a couple of examples of DIVERGENCE and what to look. This first example shows the following:

RECOMMENDED BROKERS

XM - FINMAX - ETORO - InstaForex

1. Both the market and the MACD show an upward trend with EMA10 above EMA20 (PURPLE BLUE) on the main chart and MACD above signal on the MACD chart.

2. At this point we divergence. In the candlestick chart still an uptrend indicated or purchase (EMA20 EMA10 above), but the MACD shows a downward trend with red line moving above the blue line.

3. At this point, everything becomes synchronized and both graphs show a trend of sale. The important thing to note here is that in paragraph 2indicate thatshould leave any transaction BUY as the MACD is indicating a shift in the market.

Obviously, it is very easy to see these trends in retrospect, but if you look around 13:50 in the chart's MACD, MACD (blue) and MACD (RED) lines intersect, indicating a possible shift of the market. The precise output of any operation depends on you, but this MACD signal allows you time to discover the best starting point. As you can see, the trend of buying reached its highest point before the market changed, and this happens regularly. Another useful part of MACD histogram is the element that helps to show the momentum of the market trend. As the trend grows and bars 1 become larger, the confidence of the upward trend is obtained or purchase. As histogram bars begin to decline,

Another example below ... This is a more subtle example, but again shows how MACD can show changes in the market.

At point: 1. Both the main chart and the MACD are clear trends of sale. In the main graph, the EMA10 is below the EMA20, therefore, SELL, and the MACD, the MACD line (blue) is below the line MACD signal (red) and the bottom half of the chart . RED histograms show many market momentum. At this point, the MACD crosses the signal line indicating a turn. We also see that the histogram bars become green. However, the main chart clearly still has a tendency to SELL with EMA10 EMA20 below. At this point, the MACD clearly shows a tendency to buy and is at variance with the main graph showing a sales trend, EMA10 EMA20 below. At this point, the market is once again a sales trend. So,

Download the most effective strategy Divergence