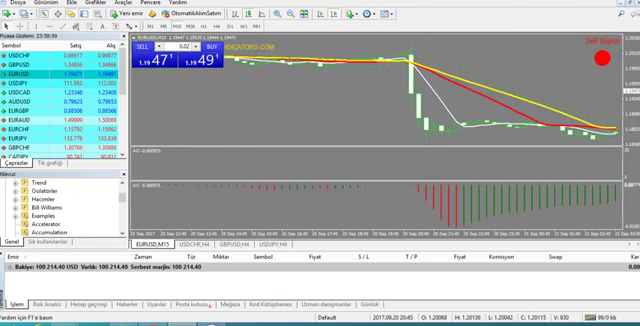

The Bill Williams Magnificent Technical Indicator (Awesome Oscillator, AO) is a simple 34-period moving average, constructed on the basis of bars (H + L) / 2, which is subtracted from the simple 5-period moving average, constructed from the central points of the bars (H + L) / 2.

This oscillator shows what happens to the driving force in the market right now.

Purchase signals

"Saucer"

It is the only purchase signal that appears when the histogram is above the zero line. Remember the following:

the "Platillo" signal is generated when the histogram changes the direction of the descendant to the ascendant. The second column is lower than the first and has the red color. The third column is higher than the second column and is green.

to generate the "Saucer" signal, at least three columns of the histogram are required.

Remember that when using the buy signal "Saucer", all columns of the Awesome Oscillator must be above the zero line.

"Crossing the zero line"

The buy signal is generated when the histogram changes from negative to positive values. In this case:

for the signal to be generated, only two columns are needed;

the first column must be below the zero line, the second column must cross the zero line (step from negative to positive);

it is impossible that at the same time there is the purchase signal and the sales signal.

"Two Peaks"

It is the only purchase signal that can be formed when the histogram values are below the zero line. Here is to remember the following:

the signal is generated when we have a downwardly directed peak (the lowest low) below the zero line following which another downward directed peak is higher (the negative number with the lower absolute value, for that is closer to the zero line) than the previous peak looking down;

the histogram must be below the zero line between two peaks. If the histogram crosses the zero line between the peaks, the buy signal does not work. However, the purchase signal "Crossing the zero line" is created;

each new histogram peak must be higher (the negative number with a lower value that is closer to the zero line) than the previous peak;

if the highest extra peak (which is closest to the zero line) is generated and the histogram has not crossed the zero line, the additional buy signal is generated.

Signs of sale

The signs of sale of the Awesome Oscillator are identical to the signs of purchase. The signal "Saucer" is inverted and is below zero. "Crossing the zero line" is decreasing: the first column is above zero, the second column is below. The signal "Two peaks" is above the zero line and is also inverted.

Formula and values

The Awesome Oscillator histogram is a simple 34-period moving average, constructed from the central values of the bars (H + L) / 2, which is subtracted from the 5-period simple moving average, constructed from the central points (H + L) / 2.

MEDIAN PRICE = (HIGH + LOW) / 2

AO = SMA (MEDIAN PRICE, 5) - SMA (MEDIAN PRICE, 34)

Here:

MEDIAN PRICE - average price;

HIGH - maximum bar price;

LOW - minimum bar price;

SMA - simple moving average.