Do you often feign exit the market or enter an operation just to see how quickly back in the other direction?

Sometimes this is inevitable, but often there is a hint of price action and a trail of where the money to make your next move if you know where to look and what to look for.

In this lesson, I will show the "footprints price action" you should be looking for and why the false jump is so powerful when you know how to use it properly.

The power of false break

The False Break is my favorite setting for some reasons, but the two main ones are;

you can trade in many time frames

you can trade with many triggers as the main entrance

So what exactly is the false jump and why is it so powerful?

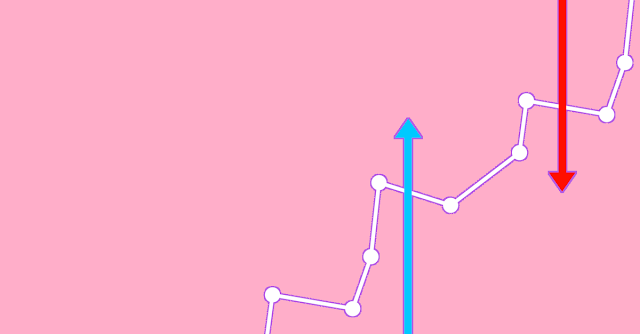

The False Break = FB is when the price makes a move in one direction, usually outside a major / key level, and then back quickly in the opposite direction.

What happens to the flow of orders and market traders believe the rapid movement of interest.

When the price starts for the first time in this example is reduced through the support, a great majority of the market starts climbing on board to go downward and go with the lowest breakdown.

Then the highest recoil and all the people who are short start having their meal begins stops.

This makes the market even accelerate as the price moves back and False Break is created.

This opens a lot of potential business opportunities high probability for you, provided you know where you need to start looking for them.

Check the pictures I've attached below ...

Figure 1 example -

This is what would happen if the price did not create the false break and break lower. This is what the price tries to try and do;

Figure 2 -

Nevertheless; the price back, rejecting the main level, closing higher and creating the false jump and investment pin bar.

Diagram Example False False High Probability:

Pin Bar

In this lesson, I will not go into how to play the false jump, the inputs and outputs and advanced strategies that trigger to enter, etc., but the pin bar is basically a false breakout, but only once frame.

In the table below, I show how the price moves quickly and then recedes.

This is the same that makes the false jump. Price makes the market move in a certain direction, and then the "tricks" or falsifies and moves back to catch.

Example chart;

Where you should look ...

You want to be on the right side of the market and make sure you are ready to jump and join the trip if adequate commercial configuration when the price rises again,.

The first thing to do is make sure not trade in areas of concern, place your stops in positions that hurt or manage their operations in places where the price is about to break and turn against him.

Many operators make entries in an area difficult for them to successfully manage their operations and then see the price quickly against them.

Once we find a configuration with an appearance of very high probability, we must evaluate it entirely on how work once the Swap completely and we manage.

Putting a Trade

When you make a trade and especially a false exchange offer, your input is entered with the strong MOMENTUM.

You are seeking to enter the market in their favor responding quickly and strongly. I will continue using the same sample charts to help you see the same images ...

To increase your chances of making a winning trade, you want to enter your false jump using a trigger signal, something like the pin bar discussed earlier.

To enter this trigger, you will use the confirmation because the last thing you want is that the false price break after you just made a jump false.

Finally, a false signal is ...

The last thing I want to leave in the lesson price action faster is that a false break is not always a big market recovers and vice versa.

It can often be a trickle above high / low and then back to the other side.

Or what is very common ... the price is a bar pin that you may have noticed that you've been in business for yourself, then price moves to the top or bottom of the tip of the bar, just after, and then - Relax!

Why does that price?

If the price has formed a pin bar means that there was a rejection of a level and there were operators who rejected that certain level. It also means that there is a high probability that if the price returns to that level that price could again stop at the same level.

False break is my favorite setting and has been for many years because if I get a lot of flexibility and allows me to operate in a variety of markets and time frames.

Like the highest probability of price action setups, there 'rules and key steps' to follow step by step.

0 Comments:

Post a Comment