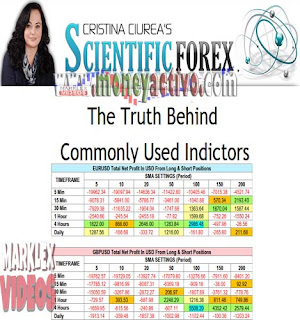

To see if the configuration really worked from a scientific point of view, I retested the flags with different configurations in a couple of currency pairs and in a variety of time frames.

To ensure that enough transactions are introduced to obtain reliable results, I ran all the retrospective tests through 4 years of historical data (January 2008 to December 2011). Using similar entry rules, stop-loss and take profit for each test, I started with a $10.000 account and established each operation to enter 0.1 lot to allow sufficient capital for operations. The spread for EURUSD and GBPUSD is 2 pips.

The rules of the tests are simple.

1. Enter the end of the candle just after the signal appears. The signal depends on the indicator or the pattern of candle reversal used.

2. Set the Stop Loss 3 pips above the highest maximum of the last three candles.

3. Set the gain of the take twice the value of stop loss.

The answers to the questions listed on the previous page will be based on some vital data from the results of the retrospective tests. Here's what we're looking for: 1. Total net worth: Of course, the best performance measure is the total gain you get from the entered operations. How good is an indicator if it doesn't help you win?

2. Percentage of earnings operations: Indicates the percentage of winning operations of the total number of operations entered. The higher the percentage, the more winners and the better the performance.

3. Drawdown: Is the difference between the highest and lowest balance of the account, in percentage. The smaller the reduction, the more stable the earnings and the better the performance.

Keeping all the variables constant, except for the configurations, I'm sure that the variations in the results are caused by the variations in the configuration

Contents :

INTRODUCTION

METHODOLOGY

MOVING AVERAGES

I. Signal/Entry Trigger

II. Settings

III. Simple Moving Average (SMA) Findings

IV. Exponential Moving Average (EMA) Findings

V. SMA versus EMA

STOCHASTIC OSCILLATOR

I. Signal/Entry Trigger

II. Settings

III. Findings

RELATIVE STRENGHT INDEX (RSI)

I. Entry trigger

II. Settings Tested

III. Findings

CANDLESTICK REVERSAL PATTERNS

I. Dark Cloud Cover

II. Engulfing Pattern

III. Hammer & Hanging Man

IV. Inverted Hammer & Shooting Star

APPLICATION

I. Improving Your Profitability

II. Examples

INTRODUCTION

METHODOLOGY

MOVING AVERAGES

I. Signal/Entry Trigger

II. Settings

III. Simple Moving Average (SMA) Findings

IV. Exponential Moving Average (EMA) Findings

V. SMA versus EMA

STOCHASTIC OSCILLATOR

I. Signal/Entry Trigger

II. Settings

III. Findings

RELATIVE STRENGHT INDEX (RSI)

I. Entry trigger

II. Settings Tested

III. Findings

CANDLESTICK REVERSAL PATTERNS

I. Dark Cloud Cover

II. Engulfing Pattern

III. Hammer & Hanging Man

IV. Inverted Hammer & Shooting Star

APPLICATION

I. Improving Your Profitability

II. Examples

FRE DOWNLOAD

0 Comments:

Post a Comment