In my daily communication with aspirants to one of the most common mistakes I see with them trying to negotiate Price Action, they fail to insert signs of reversion of the correct areas. This is a big mistake that many retailers come in and most of the time they do not even realize it.

The principle discussed in this article sounds very simple and can be used to make money not just in Forex, but life in general. It still surprises me how many traders go against it.

Remember this rule:

"Buy low and sell high" or the rest of the world "Buy cheap and sell expensive".

That sounds pretty easy, right? In Forex, we can make money with the price going up or down, but the rule remains the same. To make money, we need to be able to buy low and sell high, if we buy, or sell high and buy back down, if we stay low.

Balance Points

The easiest way to do this for price stock traders is to start entering from value areas or turning points on the chart. What this means? Instead of getting into short on the bottom of the trend, we fall short with a higher indentation or a high spin. If that does not make sense yet, stay with me, because I'll attach some graphics to make it clear.

So often the retail trader, instead of going into areas of value and break-even points using the rule above, goes on top of an upward trend to go long, and the lower part of the low tendency to go short. At these two levels, all the money has already been made and the big ones are rolling out their business and making a profit. The retail merchant will then be caught up with the price turning against them as the price moves back to an area of value, or the area where they should be coming in!

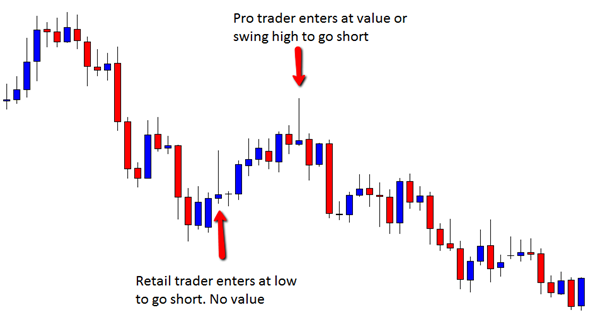

The following chart explains how this rule usually applies to a short trade. In this graph there are two pin bars. The first pin bar forms on a low swing. It is here that many retail traders are going to make the mistake of going under a low swing and waiting for the price to fall. You can see that this pin bar is well on the last bid down and where the rest of the market is making a profit and starting to stretch. Without realizing it, the marketer has just entered the market, where the pros are coming out.

The second Pin Bar shows how a professional professional enters the market. Take note of how the professional trader is coming in from a high swing. This means that the trader is selling high and buying back down. This high swing is obviously much better value area to enter than Pin Bar.

The next chart shows the same rule, but for a long trade. Remember when you go too long we want to "buy low (cheap) and sell high (expensive)". The chart below has two pin bars formed at different oscillation points on the chart.

As you can see, the retail trader is bullish and expects the price to go up even higher. The professional marketer is smarter than that and realizes that the best entries are from areas of value. The professional trader expects the price to lower to a minimum and then enter. The trader trades low and then sells high.

Create space for our business

Not only does entering the wrong wobble points on the chart mean that you are being inserted into worthless areas, but it also means that you are entering support or resistance. Entering a trade directly into support or resistance can be a trade killer because when you enter and price moves to the key level, other traders will seek to trade in the opposite direction of yours.

If you start entering only from the correct pivot points, you will begin to create what is known as "space." What this means is that instead of entering and trading directly in support and resistance, you will be entering a trade that has room to move. Your trade will have a much better chance of moving toward you because there are no levels of support or resistance to disrupt.

The chart below illustrates this rule. This pair produced a pin bar. This Pin Bar was not formed on a high swing as it should have been, but rather on a low level. Because this Pin Bar was at the wrong balance point, the price has always been negotiated on a key level. You will notice in this example that the price was being negotiated in a very obvious support area. The price dropped and, as expected, jumped from this stand to climb.

The next chart example shows a high bottleneck. Using the rule discussed in this article, we now know that if we want to go long, we should buy low and sell high. Because this BUEB is long, we can see that instead of forming on a low swing, it actually formed in the wrong high swing. As this is formed at the wrong oscillation point, the price is now being traded directly at a key resistance level. We do not want to go into negotiations directly on key levels like this. The price does what you would expect and touches that area of resistance before selling and moving down.

Stick to Reversals

The rule we are discussing today is very important. When trading reversal signs, such as Pin Bar, 2 Bar Reversion Bar or Engulfing Bar, we must always follow this rule to ensure that we are entering areas of value rather than where the rest of the market is going.

Since all the price action signs mentioned above are signs of reversal, it is even more important to follow this rule. When entering reversal signals, we need to choose the price to "roll back". This means that we do not look for signs of reversal to act as continuation signals for the market to continue in the original direction.

An example of using a reversal sign to choose the price reversal is below. The warning for this low price on the Pin Bar was going up. The Pin Bar is formed and the trader is entering a short sale at this price. By trading like this, the trader is predicting that the price will "reverse" back down, or in other words, the price will stop going up and down and back down.

This rule is the same with all reversal signs. You must choose the price to reverse and not continue!

I hope you have enjoyed this article and start using this very important rule to start trading from value areas only. Don’t get sucked in like all the other retail traders!

0 Comments:

Post a Comment