The reason why negotiate with the price action can be profitable is because, although the Forex market is random, the humans that are not traded. Traders and organizations involved in the market operate by habit. In similar situations, humans behave in the same way because of their habits. These habits are those who believe the results. This is the reason why the same patterns tend to repeat themselves over and over again in the markets and also the reason why many traders tend to be arrested again and again.

Very often in our educational articles here on Forexobroker, we discussed the need to enter operations from areas of value. We have discussed how to find value in the market, but many traders still send emails regularly do not understand why we seek to enter from areas of value, and why it is so important. I hope that at the end of this article you can detect areas of market value and make exchanges more likely. For this article we will refer to unprofitable operators as "retailers".

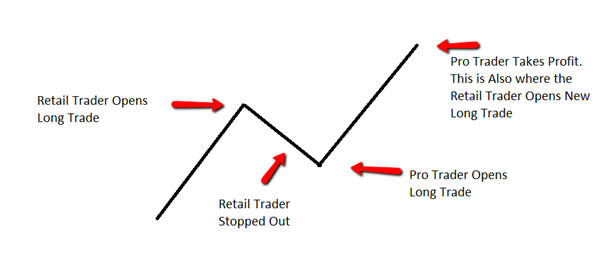

Stop enter when professionals get benefits

The following chart shows a common pattern in the Forex market. Take a moment to study this table and note the key differences between where you enter the professional and the place to enter the retailer. On the left, you will notice that the retailer buys and performs a lengthy operation when the price is extremely high. Soon after, the retailer stopped because it lowers the price from this level. At about the same time that the retailer is stopped, professional traders enter the market in stores for a long position. When the price moves more, the professional trader will cover their long exchanges and start making profits. Professional traders will begin to leave the market after obtaining solid gains.

The obvious difference in this chart above is where each trader enters his long operations. While the professional trader waits for the price down again, the retailer moves away from the end.

REGISTER IN THE BEST TRADING BROKER

The chart above highlights why the entry into operations in extreme minimum or no recoil can be very dangerous. When operators from entering these areas that are at high or low ends, the big boys are taking profits and going market. While big go and take all their money market retailers are entering. Obviously, enter the market when the big emerging is not a smart plan. The best way to avoid this scenario is to enter from areas of market value or "hot spots."

Taking operations value areas

So now we know where not to enter, the next question is where should get a merchant? The best tickets are in areas of value. These areas are where professionals value seeking to enter their exchanges.

How to detect areas of value?

Basically, value areas are reversals of price from a high low end or support or resistance. Instead of entering from the top or bottom of the market, you can find value when the price tour. The price never moves in a straight line and have to move both higher and lower no matter how strong the trend. A common scenario is that for this; buy any weakness and sell any strength. What it means is that if the price drops (weakness) from a high end, then the price can be purchased from an area value, and if the price moves higher (resistance) from a low end, the price can be sold from an value area.

Below I have attached two tables of prices. The first graph shows the price moves from a higher rearward end, lower. This is the price that shows weakness and moves to the value input for a possible purchase. Note that if the trader had entered a long operation from the high level it would have been stopped. If, however, they had bought a long trade when the price showed weakness and back off again, enter at the same time professionals enter from an area of value.

The second graph shows the same scenario, but with a short operation to sell. The price moves from the lower end back up. This higher movement is known as a decline in value.

Trading signals "investment" areas "value" support and resistance

After an operator to understand why it is so important to enter from areas of value, and how to identify them, they have to add some other key ingredients to find high probability trades. The following two ingredients that are added after the value area are;

The price action signal used for trade

Entering from support and resistance

The best exchanges occur when there are many factors pointing in the same direction. Obviously, the more factors can add as common ground for exchanges, the greater the chances that they work.

Below I have attached two examples of how to add signals key price action, solid support or resistance levels and are formed in areas of market value. Both configurations were high probability setups because of the many factors they had in their favor.

Lesson review

In life, the only way to make money is to buy low and sell high or buy low and sell high. If you want to make money in Forex, this same rule applies. A common commercial said that operators can put in trouble is "The trend is your friend". While this saying is very true, many traders do not understand how to trade successfully with the trend and enter from the value.

I hope this article has helped you understand how you can avoid getting into the market when big are leaving. Trade with the trend may be the most profitable type of negotiation and even more when operations are entered from areas of value.

0 Comments:

Post a Comment