How to Trade Renko chart

Renko box

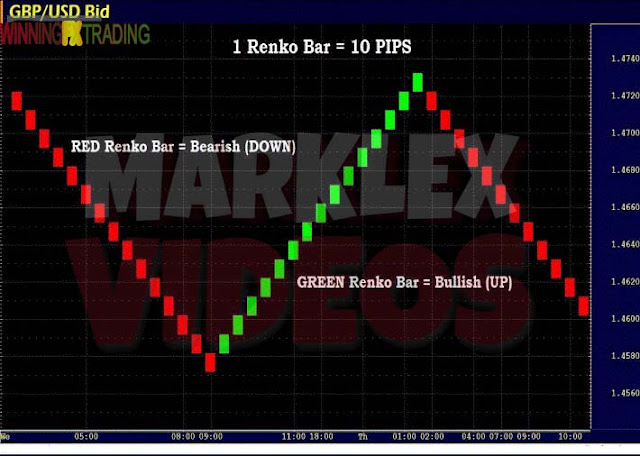

How is a renko 10 pips bar form?

1. A new green bar renko (UP) is formed only after the current price exceeds the top of the previous

Renko bar for 10 pips.

2. The green bars renko open at the bottom of the bar and sealed at the top of the bar. The renko green bars show the closing price, which is also the highest price for this Green renko bar.

3. A new red bar Renko (DOWN) is formed only after the current price exceeds the bottom of the

renko previous bar 10 pips.

4. renko red bars open at the top of the bar and sealed at the bottom of the bar. Red Renko bars show the closing price, which is also low price for these red Renko bars.

Advantage

Renko Charts Bar offers the following advantages:

1. Visual Appeal

2. Indicators zero

3. objective decision-making process

4. Filter market noise, ie, "whipsaws"

5 shows areas of support and resistance

6. Based on the price action

Renko bars clearly define the current trend and key price levels as support and resistance and trend reversals.

Buy settings

N purchase facility. # 1 represents a reversal of a trend.

Look for:

1. A trend (xy) or sequence renko green bars followed by a reverse (yz) renko red bar.

2. Wait patiently 1st green renko bar (Bar activation) closes immediately after retraction. Login trade here.

3. Make sure the last red bar Renko (z) on the graph is higher than the last red bar renko in the previous setback (x).

3. Make sure the last red bar Renko (z) on the graph is higher than the last red bar renko in the previous setback (x).

4. This configuration is a higher swing low. Place your stop loss below this lower swing (z) or previous swing low (x).

Sell configuration

Sales configuration n. # 1 represents a reversal of a trend. Look for:

1. A trend (xy) or sequence renko red bars followed by a reverse (yz) renko green bars.

2. Wait patiently 1st red bar renko (operating rod) is closed immediately after the

pull back. Login trade here.

3. Make sure the last green bar Renko (z) in figure is lower than the last bar in green renko

the previous reverse (x).

4. This configuration is a high lowest oscillation. Place your stop loss above this lower swing (z) or

above the previous swing high (x)

Scalping settings with Renko chart

1. Determine how much risk: money management

2. Identify a trade setup FX (Buy or Sell configuration)

3. Enter the trade

4. Administer exchanges / outputs

Parameters bar graph Renko:

1. 2 or 5 renko bars PIP

2. Use a table 10 TICK (look for the icon CLOCK)

3. EUR / USD, GBP / USD, USD / CAD, AUD / USD, USD / CHF,

USD / JPY, NZD / USD, CAD / JPY, EUR / JPY and GBP / JPY

outlets:

1. 3 Reverting Renko bars:

3 renko opposite color bars appear and close in the graphs. Use a stop tracking 6-15 pips if you want to "automate" this type of commercial output.

Setting 2 Quantity:

100% from the first target profit. Use a fixed to "automate" this type of commercial output gain.

Swing with renko chart (configuration)

1. Determine how much risk: money management

2. Identify a configuration FX trading

3. Enter the trade

4. Administer exchanges / outputs

Parameters bar graph Renko:

1. PIP renko 10 bars

2. 1 minute timeframe

3. EUR / USD, GBP / USD, USD / CAD, AUD / USD, USD / CHF,

USD / JPY, NZD / USD, CAD / JPY, EUR / JPY and GBP / JPY

outlets:

1. 3 Reverting Renko bars:

3 renko opposite color bars appear and close in the graphs. Use a backstop 30 to 50 pips if you want to "automate" this type of commercial output.

Setting 2 Quantity:

100% from the first target profit. Use a fixed to "automate" this type of commercial output gain.

position Trader

1. Determine how much risk: money management

2. Identify a configuration FX trading

3. Enter the trade

4. Administer exchanges / outputs

Parameters bar graph Renko:

1. 25 bars punk renko

2. 1 minute timeframe

3. EUR / USD, GBP / USD, USD / CAD, AUD / USD, USD / CHF,

USD / JPY, NZD / USD, CAD / JPY, EUR / JPY and GBP / JPY

outlets:

1. 3 Reverting Renko bars:

3 renko opposite color bars appear and close in the graphs. Use a later stop pips 75 to 125 if you want to "automate" this type of commercial output.

Setting 2 Quantity:

100% from the first target profit. Use a fixed to "automate" this type of commercial output gain.

outlets

The outlets are a very important performance of profit / loss of an operator function. Ideally, each individual currency trader needs to find an exit strategy that fits your trading personality and business objectives.

If you're a Scalper operator, Swing or Position, you need to experiment with your operation

out in an effort to maximize profits.

Speculation: I suggest starting with 3 to 5 bars Renko or stop loss 10 to 15 pips and using a

1: 1 pull out or use a stop loss of 10 pips tracking set to the initial loss of 15 pips.

Swing: I suggest starting with 3 Renko Bar or 30 pip stop loss and use a socket 1: 1 or 2: 1

a profit or use a stop loss of 10 pips tracking established in the initial loss of 30 pips.

Position: I suggest starting with a 3 Renko Bar or

75 pip stop loss and gain using a 1: 1 or 2: 1 or use a loss of tracking stop 10 pips loss in initial stop 75 pips.

Money Management

Keep your% at the same risk for each operation.

1. Conservative: 0.5% - 1.0%

2. Moderate: 1.0% - 3.0%

3. Aggressive: 3.0% - 5.0%

Conservative start until you develop the discipline to recognize the 4 FX

ejecútalas exchanges and configurations without making any mistakes.

Adjust your% risk each week. This approach will protect your trading capital when losing operations, and allow you to increase your equity faster operations when you win.

Always keep your% risk wherever you decide it should be. Adjust your position

size if you need to use a larger stop loss. Do not use higher% greater risk with stop loss.

0 Comments:

Post a Comment