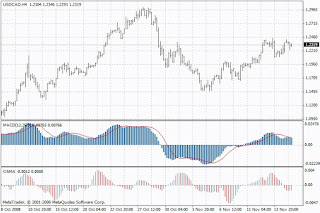

Moving Average Convergence Divergence, MACD-indicator for MetaTrader 4

The moving average of convergence divergence (moving average Convergence Divergence, MACD) is the next dynamic indicator of trends. Indicates the correlation between two mobile averages of the price.

Download here

Download here

Moving average convergence divergence, MACD

The technical indicator of moving average convergence divergence is the difference between two periods of 26 and 12 of an exponential mobile average (EMA). In order to clearly show the buying and selling opportunities, a signal line called (Period 9 moving average indicator) is plotted on the MACD graph.

The MACD is more effective in commercial markets that oscillate. There are three popular ways to use the mobile convergence/divergence average: crosses, overbought/oversold conditions and divergences.

Crosses

MACD's basic trading rule is to sell when the MACD falls below its signal line. Similarly, a purchase signal occurs when the mobile convergence/divergence average rises above its signal line. It is also popular to buy or sell when the MACD is above/below zero.

Overbought/Oversold status

The MACD is also useful as an overbought/oversold indicator. When the shorter moving average moves considerably away from the longer moving average (i.e. the MACD rises), the price is likely to be spreading too far and will soon return to more realistic levels.

Divergence

An indication that approaches the end of the current trend an end to the current trend takes place when the MACD diverges of the security. A upward divergence occurs when the convergence/divergence moving average indicator is making new peaks while prices do not reach new peaks. A bearish divergence occurs when the MACD is making new lows, while prices do not reach new lows. These divergences are more significant when they occur in relative overbought/oversold levels.

Calculation of the MACD

The MACD is calculated by subtracting the value of an exponential moving average of 26 periods of an exponential moving average of 12 periods. A simple moving average of 9 dotted periods of MACD (the signal line) is then plotted on the MACD.

MACD = EMA (Close, 12)-EMA (Close, 26)

SIGNAL = SMA (MACD, 9)

where:

EMA — exponential moving average;

SMA — Simple moving average;

Signal — indicator signal line.

0 Comments:

Post a Comment